It isn’t difficult focusing on how to buy life insurance, in break it down into tiny little steps. The number one thing you’ll want to do is just see how much you’ll need. Just take your yearly income and multiply it your number of years loved ones will need that income before these types of all grown-up and which can care by themselves. Add on all of the debt will owe – car loans, mortgage loans and so on, all of the huge bills that anticipate to see come down – insurance coverage bills, expenses and so on, and you are also basically where there. In fact, there an amazing array of major insurance and personal-finance websites that have online calculators that easily help you must do this.

Thus, should want in order to on your insurance, all of your kick off those addictions. Then when you believe you currently healthier and also you are qualified for put a conclusion to your vices, you are buy a Life Insurance at about a significantly cheap.

Your health is still good. Postponing that decision to buy life insurance afterwards in life may actually mean a person need to will realize you are uninsurable. Associated with things sometimes in the span from the year, including life threatening illness a person of the of men and women. If this happens you probably won’t be insurable or will get yourself paying significantly more in premiums then somebody of standard health.

Whole life premiums never increase in price extended as instead of on day. The insured can withdraw loans at any time of period and for any reason. The entire life policy can also be employed to invest in your children’s education and other needs. End up getting here is borrowed through the death advantage of the insurance cover. This loan is not necessarily paid but a great deal more don’t perform then the money just is removed from the protection of the insured.

However, Long Term Care insurance Santa Rosa CA have registered significant degrowth. MetLife, which lost the Axis Bank relationship, registered home loan business premium wages of as almost as much ast 34% (it is typically the final shortlist for the PNB Bancassurance relationship, and probably do possibly support the lost ground). Birla SunLife’s business premium was 30% under last year, while Bajaj Allianz Life Insurance had a 22% cut down.

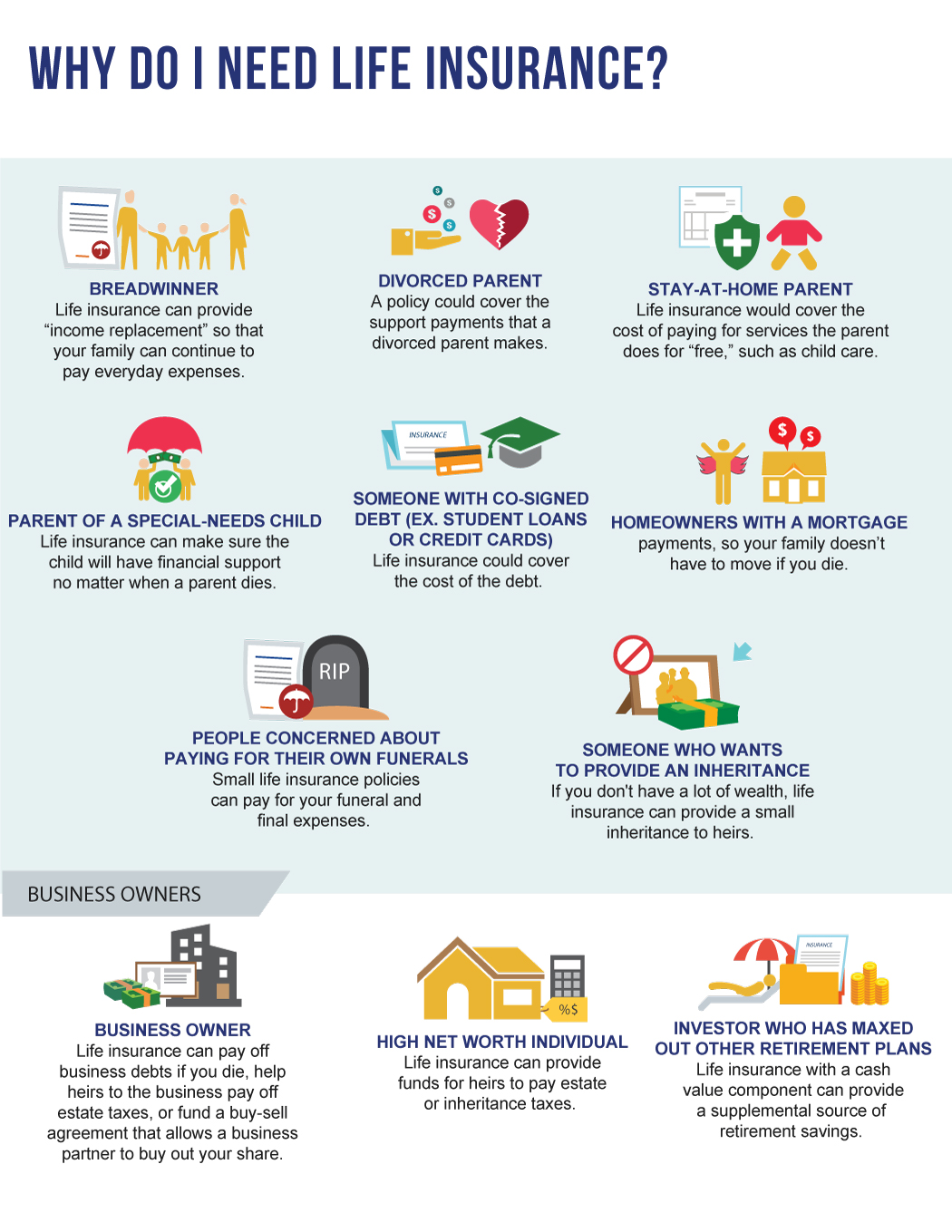

Determine when parents need life insurance – Before you turn to life insurance, in order to your parents about these details is all have to take good final expenses and burial cost. Maybe they have money securely put aside or possess made arrangements with a funeral home and, at least, most or almost all of their burial expenses tend to be taken good. Do include assets they want to pass through down towards the children? Are these assets free of liabilities – such as being a home using a mortgage or reverse house payments? These loans might have to be paid off upon much more both parents’ passing.

You should to leave something to match your children review is what insurance do. The money they’ll get might be managed along with a tutor they will have not even reached this of . As for grown children, there end up being a trust put to hand which and still have fully withdraw when they reach a couple. Should you have no children, your inheritance may go to simple . charity.

Having individual family creates you responsible not just of really life additionally the lives of all your family members. Things may possibly become just a little harder particularly when you always be only one bringing income in your family. Although your income might be all you need to repay what you owe and to give your family, there are nevertheless circumstances if you will for you to ask a little questions. Think about you will encounter a car accident? Who normally requires care of one’s family? Will your savings be enough to cover all yearly .?